- Obama to report to his bosses today: Obama Meets With Blankfein, Dimon and Moynihan Today (BBG)

- 2007 is here all over again: Seeking Relief, Banks Shift Risk to Murkier Corners (NYT)

- Kuroda Calls BOJ Inflation Target 'Flexible' (WSJ)

- Lagarde warns over three-speed world (FT)

- N. Korea’s Retro Propaganda Calls U.S. Boiled Pumpkin (BBG)

- Luxembourg To Ease Bank Secrecy Rule, Share Data In 2015 (BBG)

- Bank of Korea Keeps Policy Steady (WSJ)

- BOE Stimulus Dilemma Persists as Inflation Seen Higher (BBG)

- EU Sounds Alarm on Spain (WSJ)

- Qatar gives Egypt $3bn aid package (FT)

- RBNZ Says Deposit Insurance May Increase Risk of Bank Failure (BBG)

- Plosser Calls for Reducing QE Pace Citing Gains in Labor Market (BBG)

- Obama budget aims to kick start deficit-reduction talks (Reuters)

Overnight Media Digest

WSJ

* Luxembourg has shifted its banking policy, saying it would exchange information with the rest of the European Union about EU holders of bank accounts in the country, another step in Europe's crackdown on tax evasion.

* The European Union proposed an expansion of the bloc's powers to protect companies in Europe against unfair competition from abroad, a sign of an increasingly combative stance seen aimed at checking China's rising export power.

* Some of the biggest banks and investment firms on Wall Street were among those that received minutes of the Federal Reserve's latest policy meeting 19 hours before the market-sensitive document was released.

* JPMorgan Chase & Co's Chief Executive James Dimon, renewed his apologies to shareholders for last year's multibillion-dollar trading fiasco, and an investor that has pushed for corporate-governance changes at large financial firms said it would focus this proxy season on changing the bank's board.

* U.S. President Barack Obama took a political gamble Wednesday by proposing to curb the growth of Social Security and Medicare, hopeful that the concessions would draw rank-and-file Senate Republicans into a budget deal that has so far proven elusive.

* Changes in Cyprus's bailout made last month to win approval from its parliament increased the rescue's price tag to 23 billion euros ($30.1 billion) through the end of 2016 from an originally estimated 17 billion euros, according to draft documents prepared by the European Commission and the European Central Bank and reviewed by The Wall Street Journal.

* Deutsche Telekom AG sweetened its offer for U.S. wireless carrier MetroPCS Communications Inc, hoping to save a merger that shareholders had threatened to reject.

* Microsoft Corp is developing a new lineup of its Surface tablets, including a 7-inch version expected to go into mass production later this year, said people familiar with the company's plans.

* Federal law-enforcement authorities have reversed course and revived an insider-trading probe into how media companies transmit government data to investors, according to people familiar with the matter.

FT

Overview The European Union's largest tax haven-Luxembourg has agreed to start easing its bank secrecy rules from 2015, amid growing international pressure to tackle tax evasion.

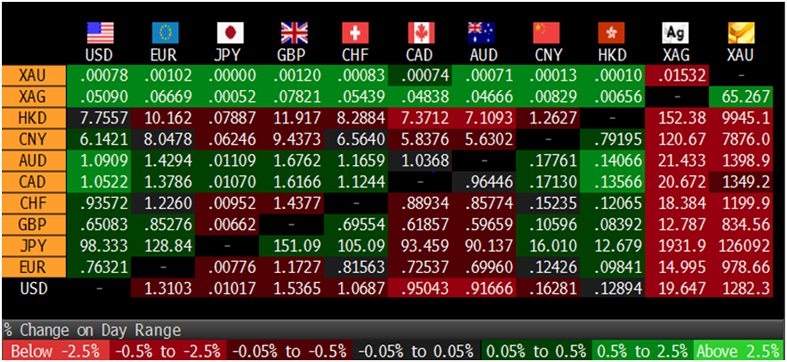

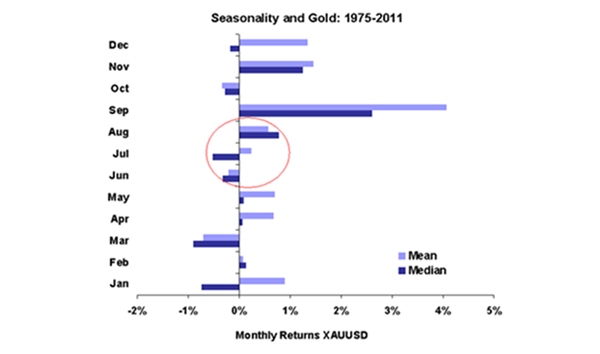

Cyprus has agreed to sell excess gold reserves to raise around 400 million euros and help finance its part of its bailout, in a move rattling precious metal markets as investors fear it could set a precedent for other troubled eurozone countries.

IMF Managing Director Christine Lagarde warned of a three-speed global economy, with the world dividing into three groups - some countries doing well, some on the mend and some still in trouble.

A boardroom rift with executives could see Mehmet Dalman, the chairman brought in to clean up ENRC, quit the FTSE 100 miner.

Trafigura raised $500 million through its perpetual bond, as the world's second-largest independent metals trader after Glencore taps into new sources of funding. Some of the biggest shareholders in Marks and Spencer are seeking greater clarity on Chief Executive Marc Bolland's strategy to stem the chronic decline in sales at the high street retailer. Goldman Sachs fended off a shareholder proposal that would lead to stripping Chief Executive Lloyd Blankfein of his chairmanship, by offering concessions to a shareholder activist group.

NYT

* The Federal Reserve alerted bank officials on Tuesday that policy makers were considering a shift on when to begin easing back on stimulus efforts, a day before the news was released publicly, but it insisted there was no evidence traders on Wall Street had benefited from what was called an error.

* Deutsche Telekom AG sweetened a bid by its T-Mobile USA unit for MetroPCS Communications Inc on Wednesday, after running into fierce resistance from shareholders of the target company.

* Goldman Sachs reached a deal with the CtW Investment Group, an organization that advises union pension funds, to halt a vote on a proposal to split the roles of chairman and chief executive. The proposal, which was sent to Goldman in January, is being withdrawn.

* U.S. federal agents secretly photographed a former senior KPMG executive accepting a cash payment in exchange for secret information about the companies he audited, according to a person with direct knowledge of the case.

* Under President Obama's budget proposal, deductions for tax breaks like mortgage interest and contributions to charities would be capped at a maximum rate of 28 percent.

* Global growth is likely to remain tepid this year and central banks should keep their easy monetary policies in place, the head of the International Monetary Fund said on Wednesday.

* On Wednesday, the research firm IDC reported that worldwide PC shipments declined 13.9 percent during the first three months of the year compared with the same period a year earlier.

Canada

THE GLOBE AND MAIL

* The Parti Québécois is setting aside its many long-standing differences with Ottawa in a bid to help collect billions of dollars in taxes hidden offshore.

Quebec Premier Pauline Marois said she supports "without any reservation" the federal government's effort to obtain a list of those who allegedly use offshore accounts to avoid paying income taxes - and is working out a way to team up with Ottawa if and when it launches legal action.

* Passport Canada, the agency that issues passports to Canadians, is projecting a quarter of its work force could be cut as it rolls out new chip-embedded, 10-year travel documents.

Reports in the business section:

* Barrick Gold Corp has suspended construction in Chile on its massive Pascua-Lama gold and silver project, responding to a court order that further delays work on a mine already a year behind schedule and billions of dollars over budget.

* Suncor Energy Inc spilled roughly 225 barrels of a renewable diesel product at a West Coast terminal Saturday, with a small amount of fuel reaching the waters of Burrard Inlet.

The facility is near Port Moody, British Columbia, and most of the fuel spilled on the ground, Suncor spokeswoman Sneh

NATIONAL POST

* A co-founder of iconic Canadian rock band Bachman-Turner Overdrive had a sexual relationship with a girl between the age of 11 and 14, a British Columbia (B.C.) judge was told this week.

FINANCIAL POST

* If the Obama administration rejects the Keystone XL pipeline, it would be a significant thorn in Canadian-U.S. relations, Alberta's premier said. Premier Alison Redford was in Washington for her fourth trip to lobby on behalf of a pipeline that Canada sees as critical to its economic well-being.

* The political will is high to conclude a free trade deal between Canada and the European Union, even if negotiations to resolve outstanding issues are taking longer than expected, Maurizio Cellini, the head of the economic and trade section of the EU's delegation in Canada, said.

China

CHINA SECURITIES JOURNAL

- Guangzhou, the capital and largest city of the Guangdong province in the south of China, will raise the minimum downpayment on second home purchases to 70 percent of the value from 60 percent if house prices rise over 2 percent in April, unnamed sources told the newspaper.

- The Ministry of Science and Technology and the Health and Family Planning Commission set up a science research project on Wednesday to prevent H7N9, also known as bird flu, infecting human beings, and expect to develop a preventive vaccine for it in seven months.

SHANGHAI SECURITIES NEWS

- The willingness among Shanghai residents to buy a car dropped 12.4 percent last quarter due to surging prices for a Shanghai licence plate, according to a report released by a local university on Wednesday.

- Shanghai will start a carbon-trading trial before the end of June as part of efforts to reduce energy intensity and emissions and hence, regulations for the trading on the Shanghai Environment and Energy Exchange will be issued within this year, according to Shanghai Development and Reform Commission.

- At a price of more than 3.7 billion yuan ($594 million), a land parcel in Tangzhen in the Pudong New Area became the most expensive residential plot sold in Shanghai in over two years on Wednesday.

CHINA DAILY

- Senior health officials in Shanghai on Wednesday denied media reports that the city might have delayed reporting the outbreak of the previously lesser-known H7N9 bird flu to the national health authorities.

Fly On The Wall 7:00 Am Market Snapshot

ANALYST RESEARCH

Upgrades

Adobe (ADBE) upgraded to Neutral from Sell at Goldman

Boyd Gaming (BYD) upgraded to Overweight from Equal Weight at Morgan Stanley

LabCorp (LH) upgraded to Neutral from Sell at Goldman

Lam Research (LRCX) upgraded to Outperform from Neutral at Cowen

Provident New York (PNBY) upgraded to Outperform from Market Perform at Keefe Bruyette

Sterling Bancorp (STL) upgraded to Outperform from Market Perform at Keefe Bruyette

Downgrades

Family Dollar (FDO) downgraded to Neutral from Buy at Goldman

Fortinet (FTNT) downgraded to Equal Weight from Overweight at Morgan Stanley

Fortinet (FTNT) downgraded to Hold from Buy at Needham

Fortinet (FTNT) downgraded to Market Perform from Outperform at Wells Fargo

Fortinet (FTNT) downgraded to Neutral from Buy at BofA/Merrill

Mettler-Toledo (MTD) downgraded to Neutral from Buy at Goldman

Microsoft (MSFT) downgraded to Neutral from Buy at Nomura

Microsoft (MSFT) downgraded to Sell from Neutral at Goldman

Initiations

Adobe (ADBE) initiated with an Overweight at Evercore

Brown Shoe (BWS) initiated with a Buy at Brean Capital

General Growth (GGP) initiated with an Outperform at BMO Capital

Kraft Foods (KRFT) initiated with a Market Perform at Wells Fargo

Macerich (MAC) initiated with a Market Perform at BMO Capital

Mondelez (MDLZ) initiated with an Outperform at Wells Fargo

Simon Property (SPG) initiated with a Market Perform at BMO Capital

SourceFire (FIRE) initiated with a Market Perform at JMP Securities

Xerox (XRX) initiated with an Overweight at Piper Jaffray

HOT STOCKS

Protective Life (PL) to acquire MONY (AXAHY) and reinsure certain policies of MLOA for $1.06B

Blackstone (BX), KKR (KKR) in group that bid $65 per share for Life Technologies (LIFE), DJ reports

Deutsche Telekom (DTEGY) submitted best, final offer to MetroPCS (PCS). MetroPCS postponed shareholder meeting to consider revised proposal

Crest Financial filed proxy statement to oppose Sprint, Clearwire (S, CLWR) merger

Fitch affirmed Regency Centers (REG) at 'BBB', outlook stable

SEC said won't pursue enforcement action against Netflix (NFLX) CEO Hastings

Barrick Gold (ABX) to suspend construction on Chilean side of Pascua-Lama

Roche (RHHBY) reaffirmed 2013 targets, expects to increase dividend

Netflix (NFLX) said it may use Facebook (FB), Twitter to disclose material information

EARNINGS

Companies that missed consensus earnings expectations include:

Apogee Enterprises (APOG), Fortinet (FTNT)

Companies that matched consensus earnings expectations include:

Pier 1 Imports (PIR), Bed Bath & Beyond (BBBY), Ruby Tuesday (RT)

NEWSPAPERS/WEBSITES

- Major buyout firms have been unloading a record amount of shares in companies they have taken public. Bain Capital, KKR (KKR) Apollo Global (APO) and other private-equity firms sold $20.5B of stock through 50 follow-on offerings during the first three months of 2013. That’s twice as many deals as in the year-earlier period and the highest quarterly pace on record, according to Dealogic, the Wall Street Journal reports

- The PC business is at a crossroads, and Microsoft (MS) is developing a new lineup of its Surface tablets, including a 7-inch version expected to go into mass production later this year, sources say, the Wall Street Journal reports

- The Bank of Japan's massive stimulus to pull the economy out of two decades of malaise has altered the outlook for Japanese assets, according to a Reuters snap poll of analysts conducted after the central bank shocked markets with its radical shift in policy, Reuters reports

- The Fed should start cutting back on purchases of housing bonds as soon as its next meeting, said Dallas Fed President Richard Fisher, hours after Atlanta Fed President Dennis Lockhart said talk of trimming the central bank's bond buys was "premature," Reuters reports

- Economists are lowering forecasts for how much Treasury yields will rise this year as the U.S.economy shows signs of slowing. U.S. 10-year yields will be 2.25 percent by Dec. 31, based on the average forecast among banks and securities companies surveyed by Bloomberg News

SYNDICATE

Chimerix (CMRX) 7.32M share IPO priced at $14.00

Chuy's (CHUY) plans to sell 3M shares of common stock for holders

Fifth Street Finance (FSC) files to sell 13.5M shares of common stock

InspireMD (NSPR) 12.5M share Secondary priced at $2.00

Performant Financial (PFMT) files to sell 6M shares for holders

Realogy (RLGY) 35M share Secondary priced at $44.00

Synergy Pharmaceuticals (SGYP) 16.375M share Secondary priced at $5.50

Quick video recap of European news via dpa-AFX