By David Galland and Stephen McBride, Garret/Galland Research

How George Soros Singlehandedly Created the European Refugee Crisis - And Why

George Soros is trading again.

The 85-year-old political activist and philanthropist hit the headlines post-Brexit saying the event had “unleashed” a financial-market crisis.

Well, the crisis hasn’t hit Soros just yet.

He was once again on the right side of the trade, taking a short position in troubled Deutsche Bank and betting against the S&P via a 2.1-million-share put option on the SPDR S&P 500 ETF.

More interestingly, Soros recently took out a $264 million position in Barrick Gold, whose share price has jumped over 14% since Brexit. Along with this trade, Soros has sold his positions in many of his traditional holdings.

Soros had recently announced he was coming out of retirement, again.

First retiring in 2000, the only other time Soros has publicly re-entered the markets was in 2007, when he placed a number of bearish bets on US housing and ultimately made a profit of over $1 billion from the trades.

Since the 1980s, Soros has actively been pursuing a globalist agenda; he advances this agenda through his Open Society Foundations (OSF).

What is this globalist agenda, and where does it come from?

The Humble Beginnings

The globalist seed was sowed for young George by his father, Tivadar, a Jewish lawyer who was a strong proponent of Esperanto. Esperanto is a language created in 1887 by L.L. Zamenhof, a Polish eye doctor, for the purpose of “transcending national borders” and “overcoming the natural indifference of mankind.”

Tivadar taught young George Esperanto and forced him to speak it at home. In 1936, as Hitler was hosting the Olympics in Berlin, Tivadar changed the family name from Schwartz to Soros, an Esperanto word meaning “will soar.”

George Soros, who was born and raised in Budapest, Hungary, benefited greatly from his father’s decision.

Allegedly, in 1944, 14-year-old George Soros went to work for the invading Nazis. It is said that until the end of the war in 1945, he worked with a government official, helping him confiscate property from the local Jewish population.

In an 1998 interview with 60 Minutes, Soros described the year of German occupation as “the happiest time in my life.”

Soros’s Venture into Finance

When the war ended, Soros moved to London and in 1947 enrolled in the London School of Economics where he studied under Karl Popper, the Austrian-British philosopher who was one of the first proponents of an “Open Society.”

Soros then worked at several merchant banks in London before moving to New York in 1963. In 1970, he founded Soros Fund Management and in 1973 created the Quantum Fund in partnership with investor Jim Rogers.

The fund made annual returns of over 30%, cementing Soros’s reputation and putting him in a position of power—one he utilizes to this day to advance the agenda of his mentors.

The Currency Speculations That Threw Britain and Asia into Crisis

In the 1990s, Soros began a string of large bets against national currencies. The first was in 1992, when he sold short the pound sterling and made a $1 billion profit in a single day.

His next big currency speculation came in 1997. This time Soros singled out the Thai baht and, with heavy short-selling volume, destroyed the baht’s artificial peg to the US dollar, which started the Asian financial crisis.

“Humanitarian” Efforts

Today, Soros’s net worth stands at $23 billion. Since taking a back seat in his company, Soros Fund Management, in 2000, Soros has been focusing on his philanthropic efforts, which he carries out through the Open Society Foundations he founded in 1993.

So who does he donate to, and what causes does he support?

During the 1980s and 1990s, Soros used his extraordinary wealth to bankroll and fund revolutions in dozens of European nations, including Czechoslovakia, Croatia, and Yugoslavia. He achieved this by funneling money to political opposition parties, publishing houses, and independent media in these nations.

If you wonder why Soros meddled in these nations’ affairs, part of the answer may lie in the fact that during and after the chaos, he invested heavily in assets in each of the respective countries.

He then used Columbia University economist Jeffrey Sachs to advise the fledgling governments to privatize all public assets immediately, thus allowing Soros to sell the assets he had acquired during the turmoil into newly formed open markets.

Having succeeded in advancing his agenda in Europe through regime change—and profiting in the process—he soon turned his attention to the big stage, the United States.

The Big Time

In 2004, Soros stated, “I deeply believe in the values of an open society. For the past 15 years I have been focusing my efforts abroad; now I am doing it in the United States.”

Since then, Soros has been funding groups such as:

- The American Institute for Social Justice, whose aim is to “transform poor communities through lobbying for increased government spending on social programs”

- The New America Foundation, whose aim is to “influence public opinion on such topics as environmentalism and global governance”

- The Migration Policy Institute, whose aim is to “bring about an illegal immigrant resettlement policy and increase social welfare benefits for illegals”

Soros also uses his Open Society Foundations to funnel money to the progressive media outlet, Media Matters.

Soros funnels the money through a number of leftist groups, including the Tides Foundation, Center for American Progress, and the Democracy Alliance in order to circumvent the campaign finance laws he helped lobby for.

Why has Soros donated so much capital and effort to these organizations? For one simple reason: to buy political power.

Democratic politicians who go against the progressive narrative will see their funding cut and be attacked in media outlets such as Media Matters, which also directly contribute to mainstream sites such as NBC, Al Jazeera, and The New York Times.

Apart from the $5 billion Soros’s foundation has donated to groups like those cited above, he has also made huge contributions to the Democratic Party and its most prominent members, like Joe Biden, Barack Obama, and of course Bill and Hillary Clinton.

Best Friends with the Clintons

Soros’s relationship with the Clintons goes back to 1993, around the time when OSF was founded. They have become close friends, and their enduring relationship goes well beyond donor status.

According to the book, The Shadow Party, by Horowitz and Poe, at a 2004 “Take Back America” conference where Soros was speaking, the former first lady introduced him saying, “[W]e need people like George Soros, who is fearless and willing to step up when it counts.”

Soros began supporting Hillary Clinton’s current presidential run in 2013, taking a senior role in the “Ready for Hillary” group. Since then, Soros has donated over $15 million to pro-Clinton groups and Super PACs.

More recently, Soros has given more than $33 million to the Black Lives Matter group, which has been involved in outbreaks of social unrest in Ferguson, Missouri, and Baltimore, Maryland, in 2015. Both of these incidents contributed to a worsening of race relations across America.

The same group heavily criticized Democratic contender Bernie Sanders for his alleged track record of supporting racial inequality, helping to undercut him as a competitive threat with one of Hillary Clinton’s most ardent constituencies.

This, of course, greatly enhances the clout Soros wields through the groups mentioned above. It is safe to assume that he is now able to drive Democratic policy, especially in an administration headed by Hillary Clinton.

Simply, what Soros wants, he gets. And it’s clear from his history that he wants to smudge away national borders and create the sort of globalist nightmare represented by the European Union.

In recent years, Soros has turned his attention back to Europe. Is it a coincidence that the continent is currently in economic and social disarray?

Another Home Run: the Ukrainian Conflict

There’s no doubt about Soros’s great influence on US foreign policy. In an October 1995 PBS interview with Charlie Rose, he said, “I do now have access [to US Deputy Secretary of State Strobe Talbott]. There is no question. We actually work together [on Eastern European policy].”

Soros’s meddling reared its ugly head again in the Russia-Ukraine conflict, which began in early 2014.

In a May 2014 interview with CNN, Soros stated he was responsible for establishing a foundation in the Ukraine that ultimately led to the overthrow of the country’s elected leader and the installation of a junta handpicked by the US State Department, at the time headed by none other than Hillary Clinton:

CNN Host: First on Ukraine, one of the things that many people recognized about you was that you during the revolutions of 1989 funded a lot of dissident activities, civil society groups in Eastern Europe and Poland, the Czech Republic. Are you doing similar things in Ukraine?

Soros: Well, I set up a foundation in Ukraine before Ukraine became independent of Russia. And the foundation has been functioning ever since and played an important part in events now.

The war that ripped through the Ukrainian region of Donbass resulted in the deaths of over 10,000 people and the displacement of over 1.4 million people. As collateral damage, a Malaysia Airlines passenger jet was shot down, killing all 298 on board.

But once again Soros was there to profit from the chaos he helped create. His prize in Ukraine was the state-owned energy monopoly Naftogaz.

Soros again had his US cronies, Secretary of the Treasury Jack Lew and US consulting company McKinsey, advise the puppet government of Ukraine to privatize Naftogaz.

Although Soros’s exact stake in Naftogaz has not been disclosed, in a 2014 memo he pledged to invest up to $1 billion in Ukrainian businesses, but no other Ukrainian holdings have since been reported.

His Latest Success: the European Refugee Crisis

Soros’s agenda is fundamentally about the destruction of national borders. This has recently been shown very clearly with his funding of the European refugee crisis.

The refugee crisis has been blamed on the civil war currently raging in Syria. But did you ever wonder how all these people suddenly knew Europe would open its gates and let them in?

The refugee crisis is not a naturally occurring phenomenon. It coincided with OSF donating money to the US-based Migration Policy Institute and the Platform for International Cooperation on Undocumented Migrants, both Soros-sponsored organizations. Both groups advocate the resettlement of third-world Muslims into Europe.

In 2015, a Sky News reporter found “Migrant Handbooks” on the Greek island of Lesbos. It was later revealed that the handbooks, which are written in Arabic, had been given to refugees before crossing the Mediterranean by a group called “Welcome to the EU.”

Welcome to the EU is funded by—you guessed it—the Open Society Foundations.

Soros has not only backed groups that advocate the resettlement of third-world migrants into Europe, he in fact is the architect of the “Merkel Plan.”

The Merkel Plan was created by the European Stability Initiative whose chairman Gerald Knaus is a senior fellow at none other than the Open Society Foundations.

The plan proposes that Germany should grant asylum to 500,000 Syrian refugees. It also states that Germany, along with other European nations, should agree to help Turkey, a country that’s 98% Muslim, gain visa-free travel within the EU starting in 2016.

Political Discourse

The refugee crisis has raised huge concern in European countries like Hungary.

In response to 7,000 migrants entering Hungarian territory per day in 2015, the Hungarian government reestablished border control in order to keep the hordes of refugees from entering the country.

Of course this did not go down well with Soros and his close allies, the Clintons.

Bill Clinton has since come out and accused both Poland and Hungary of thinking “democracy is too much trouble” and wanting to have a “Putin-like authoritarian dictatorship.”

Seeing through Clinton’s comments, Hungarian Prime Minister Viktor Orbán responded by saying, “The remarks made about Hungary and Poland … have a political dimension. These are not accidental slips of the tongue. And these slips or remarks have been multiplying since we are living in the era of the migrant crisis. And we all know that behind the leaders of the Democratic Party, we have to see George Soros.”

He went on to say that “although the mouth belongs to Clinton, the voice belongs to Soros.”

Soros has since said of Orbán’s policy toward the migrants: “His plan treats the protection of national borders as the objective and the refugees as an obstacle. Our plan treats the protection of refugees as the objective and national borders as the obstacle.”

It’s hard to imagine that he could be any clearer in his globalist intentions.

The Profit Motive

So why is Soros going to such lengths to flood Europe with hordes of third-world Muslims?

We can’t be sure, but it has recently come to light that Soros has taken a large series of “bearish derivative positions” against US stocks. Apparently, he thinks that causing chaos in Europe will spread the contagion to the United States, thus sending US markets spiraling downward.

The destruction of Europe through flooding it with millions of unassimilated Muslims is a direct plan to cause economic and social chaos on the Continent.

Another example of turmoil equaling profit for George Soros, who seems to have his tentacles in most geopolitical events.

We all understand correlation is not causation. However, given Soros’s extraordinary wealth, political connections, and his long track record of seeing and profiting from chaos, he is almost certainly a catalyst for much of the geopolitical turmoil now occurring.

He is intent on destroying national borders and creating a global governance structure with unlimited powers. From his comments directed toward Viktor Orbán, we can see he clearly views national leaders as his juniors, expecting them to become puppets that sell his narrative to the ignorant masses.

Soros sees himself as a missionary carrying out the globalist agenda taught to him by his early mentors. He uses his vast political connections to influence government policy and create crises, both economic and social, to further this agenda.

By all appearances, Soros is conspiring against humanity and is hell-bent on the destruction of Western democracies.

To any rational thinker, some global events just don’t make sense. Why, for example, would Western democracies take in millions of people whose values are completely incompatible with their own?

When we look closely at the agenda being actively promoted by the leading globalist puppet master, George Soros, things become a little clearer.

Want to read more? If you haven’t done so already, sign-up for your free subscription to The Passing Parade from Garret/Galland Research. It’s a rousing weekly romp on economics and markets, with a dose of politics and other follies. It’s free and you can cancel at any time. Click here now to start subscription today!

On Soros & Gold

David, again.

While I’m not a conspiracy theorist per se, I do believe there is a naturally occurring and constant collaboration about shared interests occurring amongst the heads of governments, corporations, investment managers and all of the bottom feeders that survive off their scraps.

What I find most interesting about Soros is that he is so obvious in his intentions and persistent in their pursuit. Given the consequences of his actions, it is also clear he’s a believer in moral relativism and that the ends justify the means.

That he turns a nice buck in his crusade for what certainly rhymes with a one-world government is a Soros hallmark.

“It allows me the money needed to fund my philanthropies” he might answer to the charges he is profiting from blood in the streets he was instrumental in spilling.

Going forward when something big is happening geopolitically, I am going to start my analysis by checking under rocks for signs of Soros.

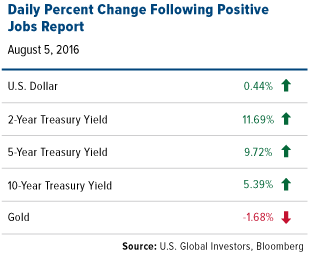

At the beginning of this article we noted that Soros has gone big into American Barrick (ABX), a leading gold producer. As of the end of March it was his single largest holding at 7.36% of his overall portfolio.

As telling, he has dumped a lot of his more conventional stocks in recent months.

Given the man’s inside track – and active manipulations – you might want to take the hint and pick up some physical gold as an insurance policy against a systematic shock.

If you already own gold, I probably wouldn’t chase it here as it has had a good run of late. Ditto silver which is up 46% year to date. But if you don’t own some, adding precious metals to your portfolio as a long-term holding, even at today’s prices, makes sense.

Per last week, I continue to believe the gold stocks have probably gotten ahead of themselves and could be in for a pretty significant correction. If so, I would be inclined to up my allocation to the sector to 20% of my total portfolio.

That said, no one can predict the future and gold could continue to power ahead, with the gold shares a more leveraged way to play the sector.

As always with gold shares, it is important to remember a few things:

- In most cases, these are speculations. That’s because their financial metrics often don’t line up with anything looking like a good value. What you are really betting on is a revaluation of the ounces of gold or silver a company is sitting on. Thus, if a company is sitting on one million ounces of gold and gold goes up by $100, the company just got a lot more valuable.

- Never fall in love with a gold stock. Set a rational return goal and once hit, at least scrape your original investment off the table. That way you are playing with the casino’s money.

Also per my article last week, keep in mind that should gold stocks buck the trend in a future global equities correction, the money managers who own big positions in gold stocks will almost certainly dump their holdings in order to dress up the rest of their portfolios. As the trading volume in precious metals share is relatively thin, you want to beat them out the door.

- Embrace the volatility. The low trading volume of most of these stocks is a key reason they have such explosive upside. Any significant uptick in investor interest can send a stock soaring.

However, the flipside is also true. In the bear market that started in 2011, the majority of the precious metals stocks lost upwards of 75% of their value and many simply dried up and went away. Enjoy the ride, but don’t stay too late at the party.

Earlier this week I commented to a friend that if the EU was going to remain relevant, there had to be some major financial pain dished out post-Brexit. To let that seminal event pass with nothing more than the equivalent of a global shrug would entirely change how people view the European Union.

The bottom line, I’m expecting some volatility, perhaps triggered by Soros taking a second run at crushing the British pound, the source of much of his fortune and fame.

It’s promising to be a long, hot summer.

Here Come the Clowns

Nothing comes close to the Get Out of Jail card handed by the clowns at the FBI to Hillary over her private email servers. This despite pretty much no one disputes she broke any number of federal laws of the sort which would have landed a lesser clown in jail.

To quote FBI Director James Comey, “Although there is evidence of potential violations of the statutes regarding the handling of classified information, our judgment is that no reasonable prosecutor would bring such a case.”

There is nuance in that statement. For starters, that there is evidence of violations. But also the stark political reality that no “reasonable prosecutor” would enforce the laws, considering who the perp is: the standard bearer for the Democrats going into this election.

Besides, going after Clinton means crossing swords with Soros and no “reasonable prosecutor” would want to do that.

Just saying…